The perception of a product or service can be shaped by the brand image of the country from which it has come. In this paper, Matt Asinari with Phil Buehler, Godfrey Philips and Richard Brandt explain how country brands can be evaluated and managed.

Companies make products and services, consumers buy Brands

A brand is the powerful combination of a company’s products, services, and much more than that. It is the embodiment of the company’s employees’ beliefs and ultimate value and values.

It is also the expression of the customers “experience”. All together, they combine, and form what we call the “brandmeaning”. A combination of tangible and intangible values, associations, and, importantly, expectations.

Countries are brands

When we imagine the same product, or service as “made in Italy”, or “in Japan”, or “in Taiwan”, or “in the UK”, or “in the USA”, we project quite different images and qualities, depending on its country of origin. Similar differences are perceived for each country’s culture and society.

Based on our proprietary Brand Asset ValuatorTMStudy, one the largest Brand studies in the world and our strategic insights, we have been able to measure and evaluate the dynamics of brands and “countries as brands”. The study was conducted in 50+ countries around the world, and on more than 500 global brands.

Brands grow by creating relevant differentiation, and then establishing esteem and knowledgefor themselves. Their brand power – which statistically is linked to sales, profitability and market valuation – increases or declines when their relevant differentiation increases or declines, despite their levels of esteem and knowledge. Profit margins, and stock prices of brands have been correlated to BAV brand power. The pillars of brand power are: differentiation, relevance which generate brand strength; brand esteem, and awareness/knowledge which generate brand stature.

We took the global strategic initiative to scientifically study “country brands”.

The findings were illuminating.

First, we found that country “brands” have the same fundamental dynamic qualities and properties of branded products/services. Consumers relate to a country’s brand identity, image, products, services and culture along the same lines as they regard products, services of an airline, healthcare, banking or consumer goods company. The country’s population values and beliefs are very much like the employees’ values and beliefs of a company. It is key to note that our global analysis is focused and based on monitoring and driving Brand and Country image, not on economic and social infrastructure measurements and drivers.

Second, we found ways to measure and evaluate a “country brand” power, differentiation, relevance, esteem, and knowledge. Third, we also found that “countries as brands” grow and decline the same way as consumer brands grow and decline.

The flag is the brand’s logo, its culture the brand’s experience.

Everything about the country is conveying something about it as a brand: its flag, its media, its people, its airlines, its places, its own branded products and services. Our hypothesis and vision is that countries can be managed as the most important brands in the world, with tremendous opportunities for the communication business.

A country’s brand is a powerful asset worth nurturing

Products and services made by that country could be leveraged to help manage the perceptions of the country.In return, branded products and services are affected by their own country’s brandperception. This is an exciting and important challenge, worth understanding and managing withappropriate resources, both at government level, industry level and by each company thatoperates in the global marketplace.

Brand image has a great impact on the value of a company. We believe the same is true for the value of a country brand.

A concerted strategic plan to build a country’s brand image based on specific government and industry leaders’ initiatives is expected to generate significant benefits both short and long-term.

Your country’s airline as your country’s top ambassador

We found that there are four strategic categories to help build a country’s brand image:

The first category, as the country top “ambassador”, is the country’s airline (or airlines), depending on the country. Many countries whose image is affected from challenging issues can leverage their national carrier, to sendpositive images, and vice-versa: the image of the airlines affects the “country brand” as we saw quantitative evidence.

The second is the countries’ own consumer products and services, such as cars, food, technology, packaged goods, banks, and many more.

The third are the branded communication and tourist programsthat the countries, states and cities develop to attract tourism.

Fourth are the government-sponsored programs. These can range from promoting technology, as in the case of many Asian countries, or branded products, e.g. Europe.

These four categories can be powerfully synergistic. Proper, concerted management of these brands at work can make a significant impact on the country as a master-brand.

Airlines’ branding, and the airline consumer’s experience are related to the perception of the country itself, and indirectly with the image of other brands from that country as well.

Carriers like Singapore Airlines have an impact on the image of Singapore, Varig on Brazil, Delta on America, Qatar Airlines on Qatar, etc. Many have updated their image/services to address country issues and, equally, leveraged their country’s image to convey their relevant differentiation.

A country’s brand power grows and declines the same way a consumer brand grows and declines.To gain insights into this marketing opportunity, we studied countries as brands in 40 markets around the world, via a tailor-made addendum to our global Brand Asset Valuator study.

What countries have the highest relevant differentiation?

In a study for the Taiwan government, we took a look at brand images of different countries within the USA. This is a key strategic market for any key client and government organization supporting their own countries’ businesses globally.

In our study, each country ranks other competitive countries in a relative way, based on their affinity and needs.

The USA analysis of countries as brands shows some important pattern and trends.

The study showed key countries that have strong brand powerin the USA, and also demonstrates the dynamic and changing nature of a country brand power.

As an example of brand power, the brand Australia has high relevant differentiation, and strong levels of esteem/knowledge in the USA. Australia’s business culture is clearly a factor that the USAfinds affinity with. The dynamic, ever-changing nature of country brand power was alsoproven, i.e.country brand power can fluctuate in a fairly short time. As an example, we monitored an interesting decline in relevant differentiation for China in the USA. This is likely due to politicaldevelopments, economic issues and the entry of other countries with similar value offeringsas China, but with greater relevance, e.g. Korea. By the same token, China’s power is expectedto rebound, in line with its long-term trends.

Canada, China and Russia: what should they do to maximize their potential?

Our USA analysis dramatized the dynamic differences between a country at the early growth stages of brand power, such as China, versus a mature leading country, such as Canada. In the USA, China is seen as a brand with very strong differentiation, with increasing relevance but still lagging strong esteem, while Canada is seen as a strong brand with relevant differentiation, and goodlevels of esteem and knowledge.

The opportunity for China the country and its brandsis tomake its strong differentiation “relevant” in the marketplace.

The challenge for Canada is to maintain its relevant differentiation vs. new, up and coming contenders. Esteem and knowledge will not be sufficient to sustain its country brand power.

Russia shows high differentiation, very low relevance and esteem, and strong levels of Awareness/knowledge, therefore no significant brand power. If and when Russia were able to find away to make its brand/experience more relevant, its power could climb, due to its high, established levels of differentiation and knowledge.We identified the same strategic global opportunity for countries such as India, Hong Kong,Mexico, Cuba and South Africa.

Some family photo albums in which the parent brand and its offspring look alike

Like a real family, we found that for most countries there is a clear relationship between the country as a parent-brand, and how consumers perceive its branded products and services offspring.

For example,Japan and United Kingdom share common traits regarding their image and their products and services image.

Japan is clearly and mostly associated with “quality/ performance”, and so are its brands, such as Sony.

Among the brands studied, we found that from Japan ,only Shiseido is associated with “prestige/style”.Lexus is showing a dynamic move towards prestige and style, but it is still associatedprimarily with quality.

Government programs like the “Explore Japan” travel campaign focused on the quality of the Japan experience, and itsvalue, consistent with the Japan’s brand qualities.

The same is true for the UK brand and its family of branded names. Most British brands, like its country, stand for quality and performance. Of the brands studied, only Rolls Royce was found to be clearly in the prestige arena.

Italian and French lead in style and performance: how a country brand can help its offspring brandsgrow their power

Among the countries studied, we found that only Italy and France had country brands that were truly focused on Prestige and Style. In addition, we found that only Italy and France had consumer brands in both the “quality/performance” arena and “prestige/style” arena.

This was not the case for other countries studied. All their consumer brands were limited to one arena, and aligned with their parent country’s image.

This is a significant strategic opportunity for Italian and French brands active in the USA.

There is a strategic opportunity for Italian consumer brands in the “quality/performance” or inthe “close/though” arena to better focus on quality delivery and achieving a prestige positionfor their products, since this value is associated at higher levels with “Italy as a brand”.

As an example, the Barilla brand, which makes quality Italian foods, has the opportunity to communicate its product quality and leverage the pleasure and prestige associated with “Italy as a brand”, for greater brand power within the food category. The same strategic opportunity could be leveraged by Pirelli tires, which could increase its image of performance and prestige, in association with its country, and Ferrari.

We believe that it would be strategically more feasible to grow brands into the “prestige” arena from the “quality/performance”, when their own country’s brand image enjoys higher prestige levels.

The Prada and Gucci brands rated high and are a strong, successful example of a good quality, prestige brand with style.

Which countries have an opportunity that should not be missed?

While we found that most established countries’ image is reflected in their consumer brands, we also found that this is not the case for developing and growing markets. There is a strategic opportunity for markets such as Korea the Middle East/Arab, and Russia countries.

Russia, for example, apart from their current image and geopolitical situation, on the long-term has an opportunity to begin and change its current negative perceptions and start rebuilding its country’s brand image by leveragingits consumer products.We found that the image of Stolichnaya vodka is clearly valued by consumer as in theprestige/style arena.

It is going to be a long climb up,as the image of Russia as a master brand is still locked in the “close andtough” arena.

An interesting case in point is Korea. The country has a tremendous opportunity to leverage the “quality/performance” imageassociated with its car brands and electronics brands such as Hyundai and Samsung. Theyhave already achieved strong ratings, despite their country’s brand image lagging behind inthe “close and though” arena. By modernizing its country image, the Korean governmentcould accelerate and multiply the momentum in favor of Korean branded businesses.

For rising countries, it is key to be strategically focused on the long term and make a connection with their brand. For example, in the Arab peninsula, the World Cup represents a terrific opportunity for governments such as Qatar.

In conclusion, the most effective way governments can create differentiated and relevant brand power is to initiate an integrated marketing program to modernize the image of their respective countries and position themselves as a “quality/performance” country brand.

This means a tight strategy aligning four power image elements: the “ambassadors”, i.e.the country’s airline (or airlines), their own consumer products and services, such as cars, food,

technology services, packaged goods, banks, their tourist programs and government-sponsored programs.

To activate this alignment, our strategic study showed that the most effective and efficient way for governments to create differentiated and relevant brand power isto initiate and focus and position themselves as a “quality/performance” country brand. This positioning area is proven to be the most likely to generate positive results, across markets, worldwide.

White Paper: MANAGING COUNTRIES AS GLOBAL BRANDS

AUTHOR: Matt Asinari with Phil Buehler, Godfrey PHilips, Richard Brandt, Y&R NY, Landor NY.

ATTICUS AWARD WINNER

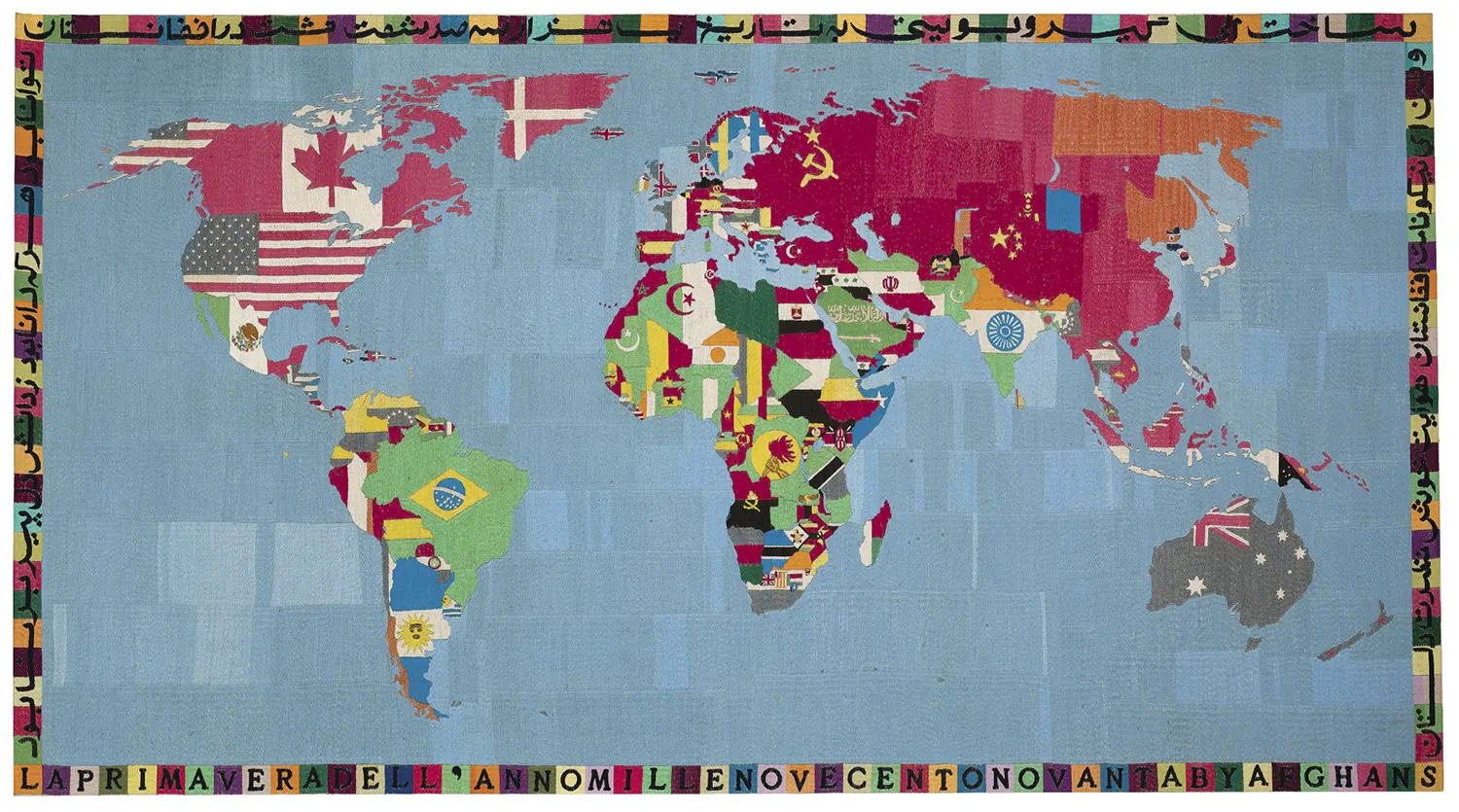

IMAGE: Alighiero e Boetti, World Map 1994